By Matt Darling

A recently released research paper from the Becker-Friedman institute has challenged the consensus view that the new Child Tax Credit (CTC) program would have limited effects on employment. The authors — Kevin Corinth, Bruce D. Meyer, Matthew Stadnicki, and Derek Wu — use data from the Comprehensive Income Dataset. They find that the CTC expansion proposed by the Biden administration (and currently being debated for permanent renewal by Congress) would reduce total employment by 1.5 million and reduce poverty rates by 22 percent. This differs substantially from previous estimates, which have generally found limited effects on employment as well as larger effects on poverty reduction (usually around 40 percent).

This is a new working paper that has not been peer-reviewed. We expect other economists to question the validity of some of the papers’ assumptions (some have already begun to do so). The paper is complex and necessarily makes certain assumptions about how to model different decisions and which parameter estimates to use. While we expect that most of these decisions are reasonable, similarly reasonable modeling choices would likely yield very different estimates.

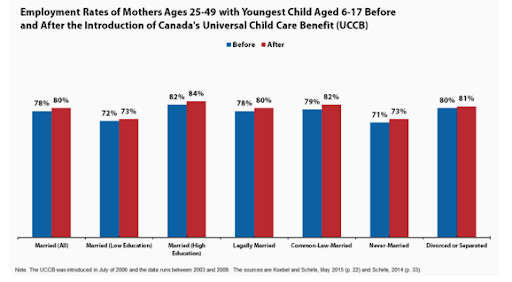

This is especially important because the significant effects the paper suggests are hard to reconcile with the observations of other countries that have created similar programs. In our previous white paper, we noted that there was no such decline in labor force participation after a similar program was introduced in Canada.

Nevertheless, it is worth taking the paper’s findings seriously as given.

A Refundable CTC Does Not Lead To An Entitlement Society

It’s first worth noting that this paper agrees with the previous literature in one crucial capacity. The paper estimates that relatively few parents (0.14 million) will leave the labor force because of the additional cash provided to parents by the expanded CTC (what economists call “the income effect”). Parents will not decide to stop working because the money provided by the CTC makes it possible for one or more parents to get by without a job. This should not be surprising: $300 a month per child is not nearly high enough to replace labor income.

If you, like Senator Manchin, are concerned that the CTC expansion will create an “entitlement society,” this paper should alleviate those concerns.

A Refundable CTC Takes the Government’s Thumb Off The Scale

Instead, the findings are driven by the “substitution effect.” The previous version of the Child Tax Credit “phased in” (such that only parents who were earning at least $24,000 a year would receive the full credit). This meant that the CTC previously operated as a subsidy for employment, effectively increasing the wages of someone who earned $24,000 to $26,000. Effectively, the government is choosing to supplement parents’ wages who decide to work rather than remain at home.

It’s worth asking whether this is the proper role for the government. While the government (or society more broadly) arguably does have an interest in helping people find work (and may choose to limit assistance for people who can work and choose not to), to claim that the government should specifically push parents into the workforce goes against many conservative principles. Some social conservatives, including Reihan Salam, Senate candidate Blake Masters, and Lyman Stone, have gone so far as to suggest that lower workforce participation by parents should be a policy objective. The Niskanen Center has previously argued that the government should largely be neutral in this decision, neither pushing parents into or away from the workforce. A fully refundable CTC achieves this goal, whereas the previous phase-in did not.

A Refundable CTC Lets Employers Phase-In

Finally, it’s worth noting that, if ending the phase-in of the CTC decreases the incentive to work provided by the federal government, there is a group that may be better suited to increasing that incentive: employers themselves.

The Becker-Friedman paper assumes that offered wages will not change in the presence of the fully refundable CTC. But if 1.5 million people are considering leaving the workforce, as the paper suggests, firms will, of course, consider how they can attract more job candidates. This may take the form of increased wages–effectively replacing the funding previously provided by the government. A result of these increased wages would be that many parents decide to keep working.

And certainly, employers may be able to come up with better solutions for attracting parents than money alone. If parents are considering leaving the workforce, businesses will look for new ways to attract them. Most obviously, this could include options such as more regular hours or limited hours that make it easier for parents to be home before and after school. That’s a pro-family policy we should all get behind.

Originally posted at: https://www.niskanencenter.org/reevaluating-the-child-tax-credit-a-response-to-the-becker-friedman-institute/