Early liberals focused on dismantling de jure social hierarchies and mercantilist policies, but the onset of the Industrial Revolution presented a new set of challenges. Though some hewed to the laissez-faire doctrines of the 18th century and were suspicious of any industry regulation, the majority accepted that, given the stark power imbalance between a factory owner and a worker, it was necessary to introduce industrial regulations to protect the latter; the first such code was passed in the United Kingdom in 1802. As L.T. Hobhouse, a prominent Liberal Party activist of the early 20th century, wrote,

…men of the keenest Liberal sympathies have come not merely to accept but eagerly to advance the extension of public control in the industrial sphere, and of collective responsibility in the matter of the education and even the feeding of children, the housing of the industrial population, the care of the sick and aged, the provision of the means of regular employment.

Two distinct paths were followed in the creation of this early benefits system: the “Bismarck model,” introduced in Germany in the 19th century, was an employer-based healthcare system. In the 20th century this system gained prominence in the United States. Elsewhere, especially in the UK, the Liberal party and later the Labour party pushed through the alternative “Beveridge model,” which started as a national health insurance system. Starting in 1911 with the National Insurance Act, much more along the lines of the Bismarck Model, the UK system was replaced with a single payer National Health Service after World War II (notably, the German system, while still relying on employer contributions, has grown to be a fully universal system, unlike the system in the United States).

While the two models are generally used when discussing health insurance specifically, they can also be used more broadly with respect to any benefit: are employers mandated to give a benefit (be it health insurance, pensions, unemployment insurance, maternity/paternity leave) to their employees, or are these benefits instead provided to every citizen universally by the government? The question has grown more acute as the public demands more benefits. Traditionally, the US has routed many benefits through employers rather than providing them publicly, but universal systems are superior both in terms of minimizing the burden on business and maximizing individual freedom, two key liberal goals.

There is a long history of requiring employers to provide benefits rather than providing them universally. In the United States, the program was built in stages. In the early 20th century, progressive reformers created early workers’ compensation programs in several states. This move was itself modeled after a Bismarckian program in Germany, and it provided at least some protection for a common class of injuries through insurance purchased by employers. Federal wage controls during the second world war gave rise to the practice of employers adding health insurance benefits to compete for scarce workers. While price controls are no longer in effect, other policies have stepped in to encourage employer-based insurance: the fact that the premiums paid for employer-based insurance are tax deductible and pre-payroll tax mean that offering benefits is far cheaper than offering an equivalent increase in take-home pay. Employer matching contributions to employee 401(k) plans are similarly subsidized.

These tax advantages, and the lack of universal health benefits, created the basis of the employer based benefit system. This system was further entrenched with the employer mandate of the Affordable Care Act, which levies dramatic fines against companies with more than 50 employees that fail to provide health insurance for at least 95% of them. While the individual insurance plan marketplaces were the most visible element of the ACA, only a few percent of Americans actually use individual plans; the great majority of mid-to-high income, non-elderly Americans are covered by company plans—in many cases, this system is legally mandated. This situation came about without, in many cases, a comprehensive plan, but the general reliance on employer-provided benefits has had cheerleaders on both the right and left, urging the creation of an employer-based system and in some cases working against more universal alternatives.

From the right, conservatives are generally more comfortable with employment-based benefits because they aren’t a “handout.” The logic goes that workers have earned benefits in addition to their wages, and so it is more just to distribute benefits through employers; alternately, if too many benefits are provided universally, the beneficiaries will not be motivated to work. Furthermore, especially since the early 1990s, conservatives have made reducing taxes a centerpiece of their fiscal policy. Even if the cost to employers of providing a given benefit is the same as the cost of taxes to provide the same benefit, the optics of mandating employer benefits are easier, especially in a Grover Norquist influenced environment.

On the left, pushing responsibility for these kinds of benefits onto employers is perhaps not preferred to providing them directly, but it is certainly not an explicitly disapproved practice. Part of this is because, influenced by the theory of surplus production, many leftists and most Marxists assume that the profits of companies derive primarily from appropriating their workers’ labor value; thus, any effort to move money back from capital to workers is seen as laudable, and the connection between hiring more employees and earning greater profits seemed obvious and inescapable, so attaching a liability to provide benefits for those employees seemed to have few drawbacks.

Moreover, it has been seen as a sort of compromise that both the right and some portions of the left can agree on—elevating workers above “slacker.” The idea seems to have been that if government provides for a smallish portion of the population that constitutes the “deserving poor,” everyone else can get a job and thus earn health insurance, pensions, etc.—and without a job, they don’t really deserve those benefits.

While this may seem a regressive stance for the left to take, this hostility to “shirkers” was a common factor in 20th century communist states, and some segments of the left seemed content to agree with it.

Finally, across the political spectrum, it seemed quite pragmatic to connect benefits to employment. Most families had at least one member working a full-time job, and the largest, richest corporations were also the largest employers. These justifications, however, have been falling apart in the last several decades, even as legislation increasingly formalizes the employer-based system.

For one thing, fewer people are full time workers, and fewer households are headed by a full time employee. Labor force participation is down to 63% (from ~67% in 2000), having fallen among men and stopped growing with women. At the same time, later rates of marriage and higher rates of divorce mean that household sizes are smaller, so fewer households will have one full time worker given the same overall labor force participation. Contract or gig labor is on the rise—quite possibly prompted, in part, by the requirements placed on “employers.” Expanding the definition of employee can help on this front, but also threatens unintended consequences. For example, Assembly Bill 5 in California, aimed largely at curtailing ride share companies contracting practices, threatens to do away with the owner-operator model of trucking as well. More broadly, in a highly flexible economy the differentiation between employer-employee relationships and those between a contractor/professional and customer are always going to be blurred around the edges.

Moreover, the connection between number of employees and profitability has essentially disappeared. Of the ten most profitable companies in the US, only one, Berkshire Hathaway, is also one of the ten biggest employers in the US. Mandating employer-based benefits burdens companies with many employees, like UPS, immensely, while costing companies that derive most of their value from intellectual property, networking effects, or capital investment, like Apple, JP Morgan, or Alphabet, very little. This, in turn, creates a questionable incentive to employ as little labor and as much capital as possible, driving up returns on investment while stunting wage growth.

Shifting from employer-paid to treasury-funded programs would thus make for a more agile system, better able to cope with changing economic and labor conditions while reducing the burden on companies and the market distortion associated with employer mandates. These costs and complications can be considerable: for companies that span multiple states, it is necessary to set up employer-based health insurance in multiple jurisdictions through multiple companies or subsidiaries thereof. Companies must employee health care insurance experts and expend hours of labor on a task—selecting and purchasing health insurance—that is far outside most of their core competencies. Moreover, many employers have responded by employing more part time workers or independent contractors when, ceteris paribus, full time employers would be more efficient but for the employer mandate. Even if the full dollar value expended on mandatory benefits were instead taken in taxes, most employers would be relieved by having a simpler, more transparent system. Businesses would also likely respond by hiring more employees, since the effective penalties for so doing would be decreased. Employers are not the only ones who would benefit, however: both employees and other citizens would enjoy the benefits of a universal system, rather than an employer based one.

It’s quite clear that employer-based health insurance and pensions are much less practical today than they were in the mid-20th century. Individuals change jobs much more frequently than at that time, averaging twelve job changes in a career. The time and energy expended on setting up new benefits, worrying about transferring coverage, etc. is a major liability for those who seek better jobs. There’s little doubt that some people choose to stay at worse paying or less rewarding jobs precisely because they want to avoid the insecurity or hassle of moving their benefits over, wondering if the new benefits (which are often quite difficult to understand) will be comparable, and so on. These frictional costs, multiplied across a major sector of the economy (most of the full time workforce has some kind of employee benefits), present the possibility for very large dead-weight losses in terms of positions that aren’t filled with the best candidates or employees stuck in jobs where they are not maximizing their productivity. Moreover, the prospect of losing one’s employer-based benefits discourages entrepreneurship by introducing unacceptable risks to the prospect of being unemployed, even temporarily.

The initial implementation of employer-based benefit mandates made sense—at the time, most households included a full-time worker, most full-time workers stayed with the same employer for a significant period, and there was little appetite for more government spending. Today, these justifications are insufficient. Both individual and corporate liberty would be maximized by removing many employer-mandated benefits and replacing them with universal benefits available to any citizen. Doing so would allow for a smoother employment market, more confident hiring by companies, and an overall more productive citizenry, to say nothing of the relief it would bring to millions who feel trapped in their jobs, or in perpetual fear of a layoff, because their critical benefits are still tied to their employer. Furthermore, while often derided as ‘expanding’ government, a universal benefit system in fact makes government involvement in the economy more transparent, and distorts the rest of the economy less than the carrots and sticks used to enforce the employer based system. Indeed, providing universal benefits grants each individual substantially more effective liberty, as it allows individuals to enter into more varied work relationships, including part time, ‘gig’, or entrepreneurial work, or leaving the formal labor force to for education, family, or other pursuits, without fearing the loss of their benefits. Demands for more comprehensive benefits, in terms of healthcare, leave, pensions, or even minimum income, ought to be met with universal services to the extent possible, rather than by placing additional mandates on employers.

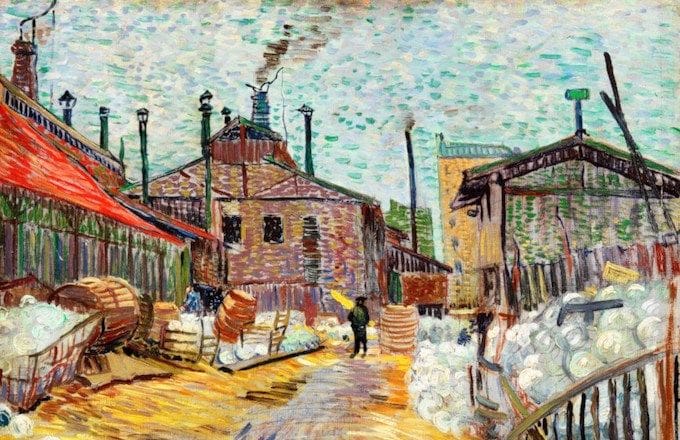

Featured image is The Factory, by Vincent Van Gogh