To save the British economy, don’t just open shops – give people the cash to spend

Rishi Sunak needs to think radically by introducing a universal basic income until this crisis passes

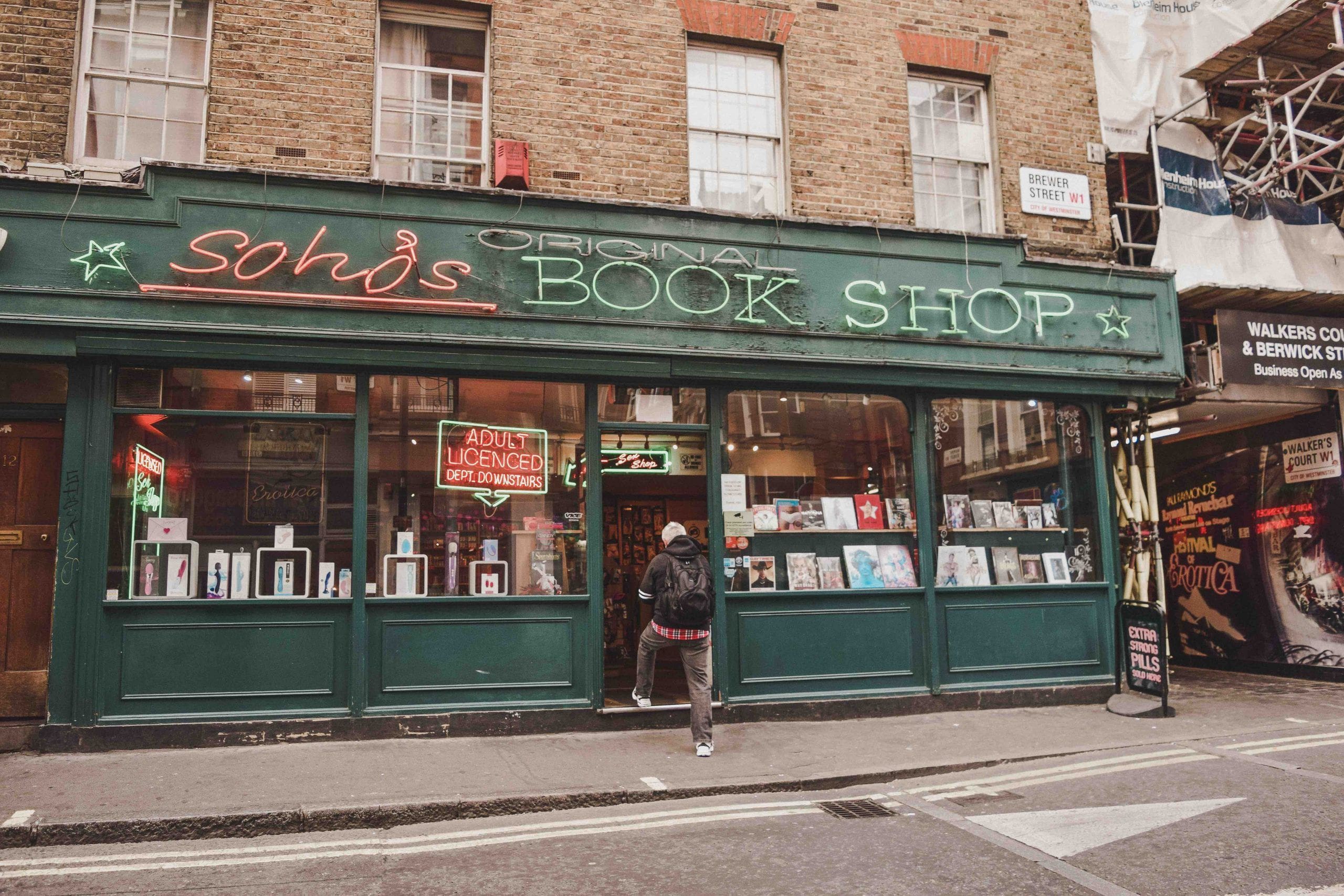

My local high street has refitted itself for today’s reopening of non-essential shops, enabling customers to stay 2 metres apart. Businesses have spent thousands in a frantic attempt to stave off imminent bankruptcy. Yet within a week that money may have to be spent again, as Boris Johnson teases that he may change the distancing rule from 2 metres to 1 metre.

This is toy-town government. Nowhere else in Europe seems to be behaving in this way. The image is of toffs in secure jobs playing maths with other people’s lives.

Shopkeepers are victims not of any disease but of a panicked political response to disease, to deprive them of trade. Plenty of other countries, among them Japan, Sweden and South Korea, did not close their retail sectors. With scientists refusing to take sides on the 2-metre rule, the block seems to lie with ministers who so inflated people’s fear they now dare not return to normality.

Everything must be done to restore earning and spending. This week a further £150bn is expected to be added to the £645bn of the Treasury’s quantitative easing. But this is money going mostly in the form of debt into the banking system, including schemes to help businesses through the crisis. The official estimate is that direct government spending will rise by £337bn, but of this only half will go straight into people’s pockets through the furlough scheme.

Nine million people – a quarter of all employees – may be getting paid not to work by the government, but this will tail off in August, leading unemployment to soar, possibly past a staggering three million. With large chunks of the economy still in lockdown, as the chancellor himself has admitted, this will be suicidal. To the OECD, it will be the worst outcome of any western economy.

Rishi Sunak must think radically. There is no point in saddling individuals, companies or future generations with soaring debt. The British economy needs customers, not debtors. It needs cash. So-called “printing money” is what governments have done in emergencies throughout history. They are doing it now. Germany is distributing €300 cash to every child and €6,000 rebates for buying low-carbon cars. The US is proposing to hand out $1,200 to (most) adult citizens. China, Australia, Japan and France have all gone down the handout route. This is the quickest of economic blood transfusions. Above all, it does not have to wait on banks. It is recovery led from the ground up, from the market place.

Who pays for this money? No one, unless government defines it as “borrowed” from itself. Of course cash handouts can, under reckless regimes, veer into rampant inflation and disaster. Britain is not reckless, and inflation is close to zero. But with a soaring unemployment rate and capacity lying idle, the one thing the economy needs is the cash of which its government, if with the best of intentions, starved it three months ago.

Sunak should slash VAT and extend his direct payments to all who need it for the remainder of the year. The government owes all Britons a universal basic income until this crisis passes. As for the cost, it should be written off. Let the bankers howl.

Simon Jenkins is a Guardian columnist