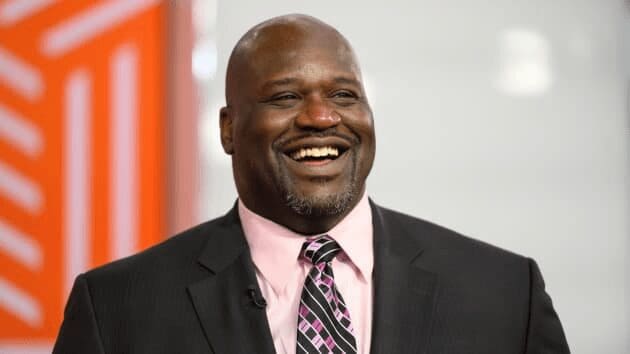

Steady, the tech platform cofounded by Shaquille O’Neal, has a community of 4 million members made up of contractors and gig workers in need of more income stability. But it’s also helping policy makers measure the effect of direct cash assistance.

By: TALIB VISRAM.

Original Post: https://www.fastcompany.com/90711325/this-is-the-company-that-guaranteed-income-pilots-use-to-get-people-cash

Tacoma, Washington, is the latest U.S. city to roll out a guaranteed income pilot program; it’s called GRIT, or Growing Resilience in Tacoma.

In December, the city initiated a year of payouts of $500 per month to 110 people residing in lower-income zip codes, single-parent households, and with household budgets of less than $52,000 (which is about 20% less than the median household income).

It’s the latest of a long list of similar pilot programs across the country, and one that’s part of the Mayors for a Guaranteed Income (MGI) coalition. It’s also one of the several MGI pilots for which the host city is using a financial tech company to ensure seamless fund distribution.

The company, Steady, stresses that its delivery system is not only a smooth option but also the most informative because it collects data on how the recipients interact with the money, which can be vital for the final reports MGI aims to publish to convince the federal government to implement guaranteed income programs on a national scale.

Steady (one of Fast Company’s 2021 Brands That Matter) is an “income intelligence platform” that builds tech models to help part-time workers increase their earnings. It’s formed a community of 4 million independent contractors, freelancers, and 1099 workers who can’t rely on the comfort of a predictable—well, steady—income.

Adam Roseman, the company’s cofounder and CEO (the other cofounder is Shaquille O’Neal), calls the community a “quasi-union,” but one for the tech age. “Here, they are benefiting from the power of data,” he says. Through that data, Steady shares income trends with the community and empowers members to enhance earnings through cash rewards, grant programs, and other opportunities. The company claims that the average member has increased their income by $5,500 since sign-up.

Thanks to its large base and knowledge of subscribers’ financial needs, Steady also has been able to help distribute public benefits. Since 2017, the company has worked with state and local governments to help disburse unemployment, Medicaid, and Supplemental Nutrition Assistance Program (SNAP) benefits. Many part-time workers and contractors have a hard time finding ways to qualify for public programs; Steady automates the process to achieve faster and more accurate delivery. For instance, it’s working with the Louisiana Workforce Commission to verify income for 1099 and hourly workers for pandemic and disaster relief.

Given its proven distribution capability, Steady began testing an emergency cash grant program funded largely by the Workers Lab, a nonprofit dedicated to workers’ rights advocacy.

“We could see when a 1099 gig worker had an income shock,” Roseman says; Steady provided those workers with one-time grants of $100 to $1,000, deposited automatically. It collected data on participants’ spending habits, outgoing payments, and how fast they got back on their feet. It rolled out the grant program at scale during the pandemic, and with the help of various nonprofits has so far disbursed $4 million.

That method of no-strings-attached payments is, essentially, a guaranteed income program. Via its collaboration with MGI, Steady gets participating cities’ list of recipients, who download the app, create an account, and link up their bank account for direct deposit. Every payment period, Steady automatically sends the cash to each bank account. Because of the robust community it’s already assembled, in some instances Steady also coordinates the initial selection of recipients once it has a city’s targeting requirements.

Roseman says that aside from the ease of automated payments to recipients it enables, the Steady platform offers the benefit of real-time data collection.

Some cities are instead choosing to use a local bank or prepaid debit cards. “We’re certainly supportive of that, but that doesn’t solve the measurement issue,” he says. Since most of the data comes from bank deposits, using recipients’ usual bank accounts allows for a “fuller financial picture.”

The data is important, because MGI’s ultimate goal is to influence policy on a federal level by showing the success of guaranteed income pilot programs. The coalition works with the University of Pennsylvania’s Center for Guaranteed Income Research, founded specifically to consolidate the pilot programs’ learnings to advocate for a national version. While there are interim reports, the final aim is to publish a large, coordinated evaluation of all results after the pilot programs end. “The power is going to be the outcome of all the cities together publishing their results in a way that’s unified,” Roseman says.

Currently, Steady is managing the cash distribution for eight MGI programs, including the Tacoma pilot, and other active experiments in Atlanta; in Santa Fe, New Mexico; and in Providence, Rhode Island. Upcoming pilot programs are set to launch in Pittsburgh; Baltimore; and Gainesville, Florida, the latter of which is launching January 15 and will send $7,600 over the course of a year to formerly incarcerated people. Separate from MGI, Steady operated the distribution in three now-completed pilot programs conducted by Humanity Forward (former presidential candidate Andrew Yang’s nonprofit) in Los Angeles; Austin, Texas; and Nashville, Tennessee.

Looking at the data so far, Roseman says it echoes the findings of other reports that have shown long-held myths about cash assistance to be false, including that recipients don’t spend money wisely, or that they stop working. He’s seen that recipients are able to increase incomes faster with the comfort of assistance; they can worry less about day-to-day expenses and focus instead on finding work for the long term. The result, he says, is that “you see people getting back to work far more quickly than they would had they not received the grant.”