Original article: https://dailycaller.com/2021/10/22/mosler-alarm-national-debt-is-misguided/

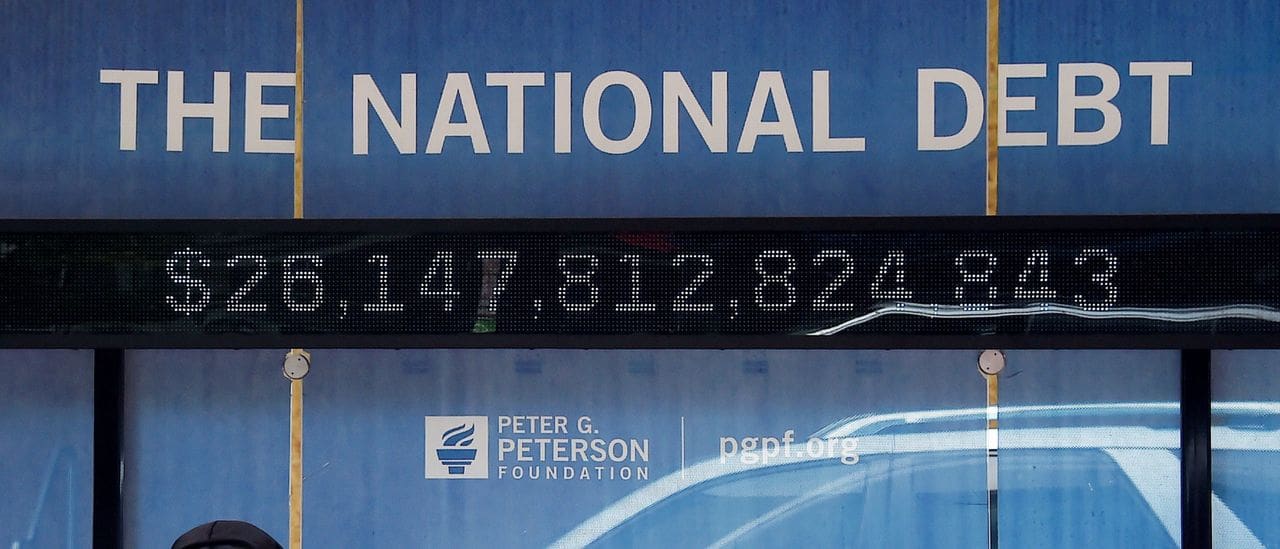

As the U.S. public debt approaches $30 trillion, the same misguided alarms have been sounding that I’ve been hearing continuously for all of my 50 years in finance.

First, the public debt per se is a residual calculation. It’s the dollars spent by order of Congress that haven’t yet been used to pay taxes. It’s not wrong to call it the net money supply. And, of course, an economy needs a money supply to function, and a growing economy needs a growing money supply.

Second, until Modern Monetary Theory (MMT), everyone thought the government needed to collect taxes or borrow in order to spend. Unfortunately, they’ve had the sequence backwards for a very long time.

MMT recognizes that the dollars needed to pay taxes and buy treasury securities come only from Congress’ designated agent, the Federal Reserve Bank, and its fully regulated member banks. Therefore, as a point of logic, agents of Congress spend first to provide the economy with the dollars that are then used to pay taxes or purchase government securities.

When Congress spends, the Fed is instructed to credit the appropriate member bank account at the Fed, which is called a reserve account (as in the Federal Reserve Bank).

As former Fed Chairman Bernanke testified, “…we use the computer to mark up the number in their account…” It’s simply a matter of scorekeeping.

Likewise, when taxes are paid and the check clears, the Fed debits (lowers the number) a member bank’s reserve account, and that member bank just lowers the number in the tax payer’s bank account. The dollars don’t “come from” anywhere or “go to” anywhere. The Fed doesn’t have or not have any dollars. It just changes numbers up and down, and accounts for what it has done.

Deficit spending is when the Treasury spends more than is paid in taxes. So if total government spending is $10 trillion, that much is added to our bank accounts. And if we pay $5 trillion in taxes, that much is subtracted from our bank accounts, leaving a $5 trillion in our bank accounts which equals the $5 trillion of deficit spending.

And it’s after we receive the $5 trillion that we buy $5 trillion of Treasury securities, which are nothing more than dollar deposits in what are called securities accounts at the Fed. They are functionally identical to savings accounts at commercial banks.

This means the purchase of Treasury securities merely shifts dollars from reserve accounts at the Fed to securities accounts at the Fed.

And when they come due, the Fed shifts the dollars back to the reserve accounts. There are no taxpayers or grandchildren in sight when that happens every month.

With a monetary system where the dollars to pay taxes and buy bonds come only from the government, the notion of the government running out of dollars, becoming insolvent, crowding out borrowers or driving up interest rates is entirely inapplicable. Mainstream economists have been rapidly catching on and modifying their models and their narratives accordingly. And as it is realized that the public debt is just the net money supply for the economy, that it already is “the money” and not something that gets “paid back” in the normal sense of that expression, analysis shifts from solvency fears to the effects of the actual government spending and taxing, which is what matters.