‘Payments may be making their way into mutual funds and ETFs’: Goldman Sachs analysts wrote.

Stock-market investors poured a record amount of money into U.S. equity mutual funds and exchange-traded funds in the past week as the Dow Jones Industrial Average topped another milestone and the S&P 500 index also touched a record.

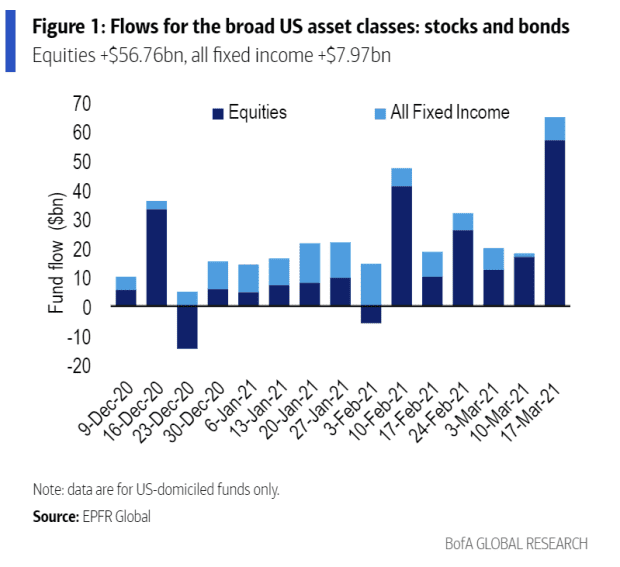

BofA Global Research on Friday said U.S. equity inflows hit a weekly record of $56.76 billion in the week ending March 17, up sharply from $16.83 billion a week earlier. The Dow DJIA, -0.28% on March 17 closed above the 33,000 for the first time, while the S&P 500 SPX, -0.18% also finished at an all-time high.

Meanwhile, Goldman Sachs estimated that net flows into global equity funds hit a nominal record of $68 billion in the week ended March 17, which when scaled to the level of mutual-fund equity assets was the largest since December 2014.

The rise was largely due to bigger net inflows into the U.S. market, which coincided with the initial distribution of stimulus checks of up to $1,400 for qualified U.S. citizens as part of the $1.9 trillion COVID-19 relief package signed into law by President Joe Biden earlier this month, said analysts at Goldman Sachs, in a Friday note.

Through March 17, the Treasury had distributed $242 billion in stimulus checks, or around 60% of the expected total.

“These payments may be making their way into mutual funds and ETFs, as well as other assets,” the Goldman analysts wrote.

“All industry categories saw positive net inflows on the week; the largest net purchases as a share of [asssets under management] were of industrials and telecom.

Surveys have attempted to gauge how much of the stimulus checks were likely to find their way into the market, including via individual stock buys and purchases of other assets, including bitcoin.

Both the S&P 500 and Dow pulled back from Wednesday’s records, as a continued selloff in the Treasury market pushed the yield on the 10-year U.S. Treasury note TMUBMUSD10Y, 1.650% to a 14-month high above 1.75% on Thursday.

BofA said government bond fund inflows weakened to just $60 million from $1.18 billion the previous week amid still-elevated volatility in rates, while municipals and mortgages saw inflows of $1.09 billion and $300 million, respectively, not far off the $990 million and $470 million seen a week earlier.

_____

To see original article please visit: https://www.marketwatch.com/story/investors-poured-record-56-8-billion-into-stock-market-funds-as-stimulus-checks-arrived-11616177039