New data on consumer spending in the retail sector dipped in May after peaking in March with the passage of the third round of stimulus checks. Will another check be sent?

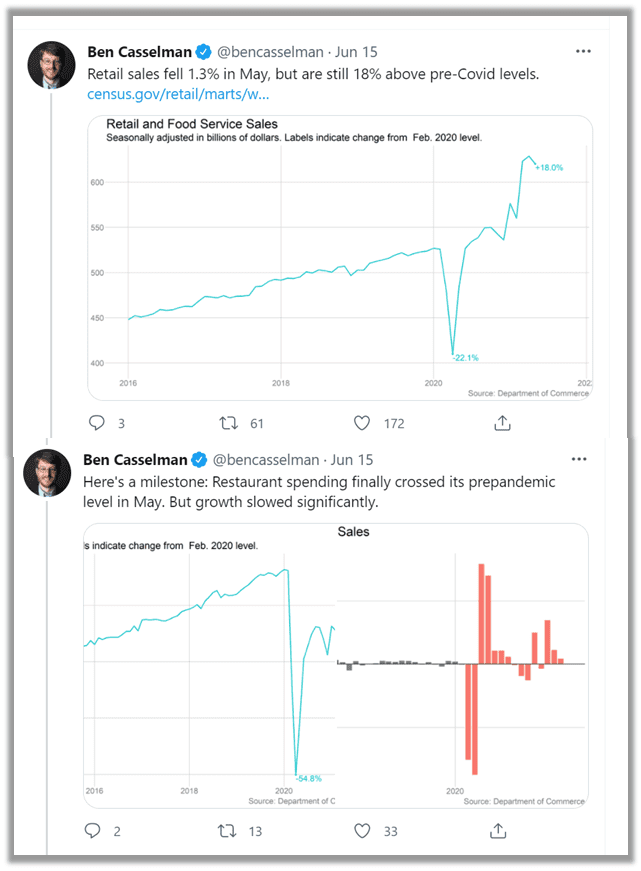

According to data from the Department of Commerce, consumer spending in retail increased almost ten percent in March after the third round of stimulus checks were sent. However, spending levels declined in April, increasing .09%, and continued their downward trend even further in May to -1.3%

The data from federal agencies shows that after the third direct payment was distributed, people spent more. These increases were thought to be a cause of virtuous cycles wherein businesses taking in more revenue, would be more likely to staff up. With increases in the workforce, more money begins to circulate throughout the economy as workers begin spending their paychecks. But, this is only partly shown in the data, with unemployment continuing to decline, but spending also facing a downward trajectory.

Could declines in retail spending mean another stimulus check is on the horizon?

Some policymakers looking at consumer spending data and the beneficial impacts direct payments have had on families in the US, support passing an additional stimulus check. However, momentum seems to be waning on Capitol Hill as the legislatures try and work out a deal over infrastructure, and other priorities, before heading home for summer recess.

While the May numbers did not surpass the levels seen in April, some economists are not concerned as they are still above pre-pandemic spending levels. What would begin to concern lawmakers and experts is if the decline continues to levels seen in the early stages of the pandemic or even before. For context, in February 2020, consumer retail spending totaled 525 billion dollars. Last month that figure was 620 billion.

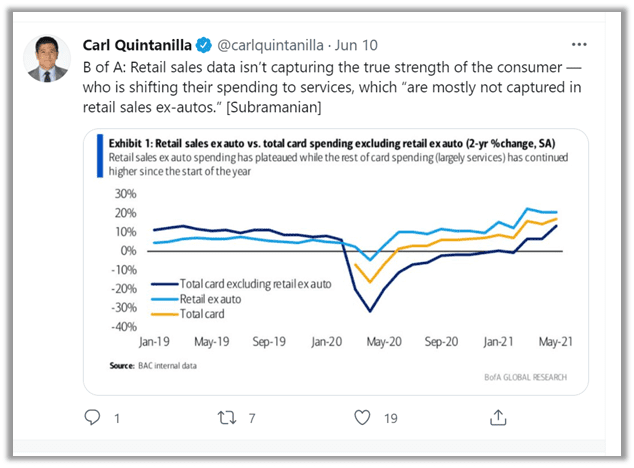

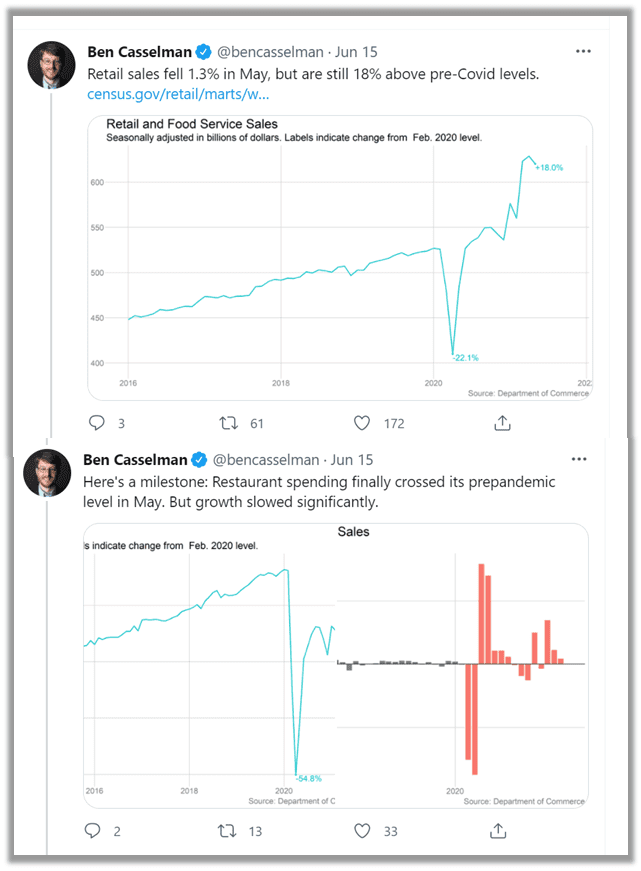

The New York Times reported on their discussions with experts who believe the data shows that “consumers have most likely spent all they need to furnish their homes or upgrade their phones during the homebound months of the pandemic.” Rather than spending in the retail market, they are shifting to others, including travel and dining.

An entire picture of spending in the economy will be available later this month when the Bureau of Economic Analysis releases data on consumer spending across markets and sectors. Throughout 2021, retail spending and the broader indicator have moved in unison, meaning that households may be holding onto their money or do not have the disposable income needed to spend at the levels they did in March.

If spending levels continue to drop, it may be a sign to lawmakers that more direct payments are needed. June, July, and August spending data will be critical to understanding the current trends for two main reasons.

The first factor is the impact vaccination will have on spending as summer in the US begins. With more Americans reporting that they feel comfortable traveling, dining, going to the movies, concerts, and sporting events, there is sure to be an impact on household spending.

However, the second factor could lead to a decrease in spending. A student released by the National Bureau of Economic Research found that almost seventy percent of unemployment claimants have seen incomes that surpass the levels from when they were working. As dozens of states cut federal pandemic-related unemployment benefits and workers reenter the labor market to jobs that pay them less than what they were making on unemployment, spending could decrease.

In September, when federal unemployment benefits end across the US, lawmakers will have a multitude of indicators and data to evaluate whether the economy would benefit from another round of stimulus checks.