BY: TAHRA JIRARI

Original Post: https://www.niskanencenter.org/an-expanded-child-tax-credit-aids-entrepreneurship/

Despite the best efforts of advocates, the expanded Child Tax Credit (CTC) expired in 2021. Some in Washington, including Senator Joe Manchin (D-WV), argue that the expanded credit discourages parents from working. As this long-standing debate continues, some new data on how the CTC may spark new business formations might help allay related concerns about workforce participation.

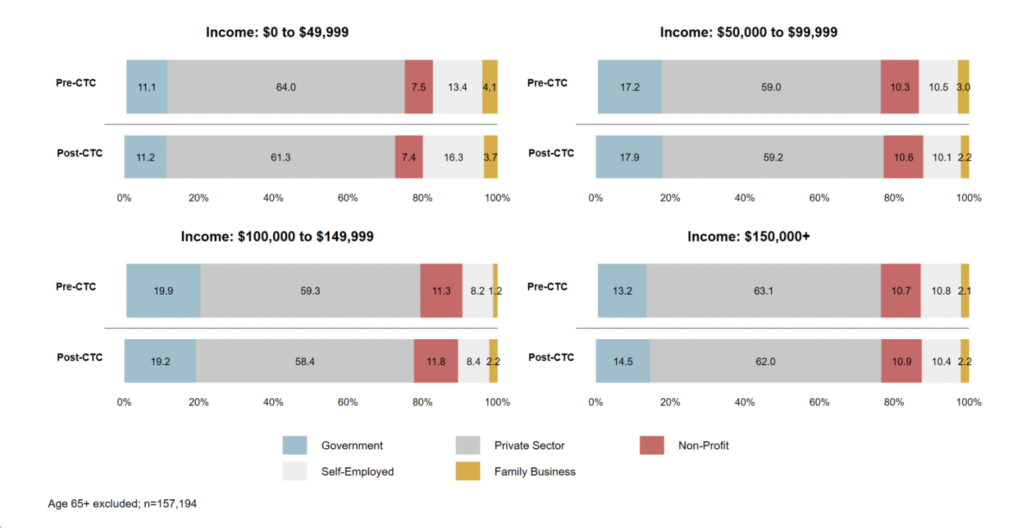

According to a recent study, the CTC increased self-employment among low-income recipients by 2.9 percent. This was predominantly in low-income households and Hispanic, Black, and Asian families. Figure 1 illustrates how the rise in self-employment varied across income groups. On a percent basis, the highest increase occurred in self-employed individuals with incomes in the $0 to $49,999 range, signaling the expanded credit allowed families to become entrepreneurs and start businesses.

Figure 1: Type of Employment among CTC-Eligible, by income

These findings align with a 2016 study that showed that the Supplemental Nutrition Assistance Program (SNAP) spurred new business creation. The SNAP benefit increased the rate of business formation and saw newly-eligible households were 20 percent more likely to own a business. These findings led the study’s author to observe, “entrepreneurs are actually more likely than any other American to receive public benefits.” Overall, the benefit’s expansion led to growth in labor supply equaling 1.1 million additional workers.

If you expand public programs, you support entrepreneurship

While SNAP only supplies in-kind (non-cash) benefits, the CTC provides direct cash payments granting more flexibility in spending habits. Comparatively, “after three months of the guaranteed monthly payments, the amount of parents with incomes under $50,000 describing themselves as self-employed increased by 22%.”– a much higher rate given the short time frame, in contrast to the SNAP study, which measures the impact over a 15-year interval.

This increase in self-employment stems from the added financial flexibility cash transfers offers. It allows families to address costs, such as child-care, transportation, and education-based tools and put the remaining funds towards expanding their business.

Both studies suggest that aid allows people to invest in new businesses at a slightly higher rate with the flexibility of cash payments.

As our colleague Samuel Hammond has argued, strong free markets and robust income security are interdependent. Promoting productive risk-taking and entrepreneurship through monthly benefits acts as an unconditional income floor, providing households with certainty while protecting entrepreneurs from volatility.

Although some policymakers remain concerned about the potential to disincentivize workforce participation, recent CTC data highlights that the expanded benefit increases self-employment. If families are receiving monthly benefits, they are better positioned to take entrepreneurial risks and seek self-employment. With a lapsed expanded CTC, we are preventing the growth of entrepreneurship in America.